May 2024 Market Update

- Federico Donadio

- May 2, 2024

- 5 min read

Updated: Apr 10

The Thing About Roller Coasters Is . . .

Remember back to when you were a kid riding that roller coaster? O.K., maybe it was last week. You slowly rise from ground level. Remember that “click clack’ “click clack’ that got slower and slower – a little faster as the first cars started down the other side. Suddenly, antigravity kicks in, your stomach moves to your throat, and you are headed down at breakneck speed.

It’s fun! Well, for some people, it’s fun. It is fun because there is an expectation and confidence that eventually you get to the end of the run, climb out windblown, go eat stuff that tastes great but is really bad for you, and hang out with friends the rest of the day.

It can be more nerve-racking when the market does roughly the same thing as that roller coaster. When you’re younger, it can still be fun. You have a long-run rate; you are not counting on your portfolio to go to the grocery store or pay rent for the rest of your life. You can just put more money into good companies when they hit those big drops. Things are not as much fun when you get a little older, just like with a real roller coaster. You are no longer expected to be “safe” at the end of the ride.

The markets have been on a bit of a roller coaster ride this past month, and you may be wondering how to;

Position Yourself to Profit:

As I mentioned, if you’re a bit younger and have the stomach for it you may find yourself looking for more cash to jump in for more rides. My guess is that many people reading this note are not in that category, so first, a chart for context.

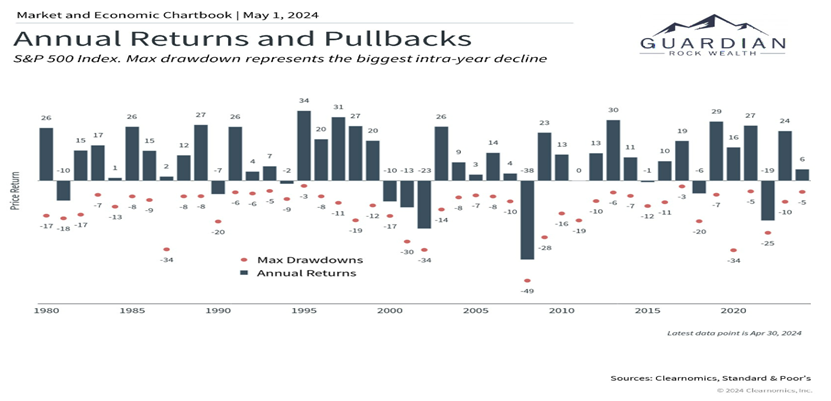

As you can see, if history is any guide, drawdowns happen every year. Twice, there have been drawdowns in the S&P500 (since 1980) of 34%, and the market ended the year on a positive note.

While that may give some solace to some of you, it is important to keep in mind that while many are obsessed with calendar year-end, the reality is the only thing that matters to you is when you need to spend the money to live your best life. This is why as there are two things you should constantly be vigilant and consistent with in my opinion especially as you get closer to or are in retirement.

Remember that cash flow is king. Keep a portion of your portfolio in cash flow-producing securities, and remember bonds are not a hedge for stocks, and they often are just as volatile. There are other better options to use for your cash flow than traditional bonds.

Remember that ‘You never go broke taking a profit.’ Be consistent and disciplined in shaving off some of those profits. Watch your “portion control.” No matter how much you love a company or how well the company is doing, there are still risks.

Yes, you will likely “miss out” on some additional profits and you will also likely miss out on some of those big drops.

Yes, you may have to pay taxes if you were not able to have these investments in a tax-advantaged account, and yes, losing 30% or more due to market movement is worse than paying your taxes. Remember, paying taxes means you made money, which is the objective.

This is not timing the market but being disciplined and systematic in your approach. You may not be able to brag in front of the proverbial water cooler as much as someone else, but then again, as I get older, sleeping well at night is much more attractive than those bragging sessions.

Digging A Little Deeper into the – Why & What May Be Next:

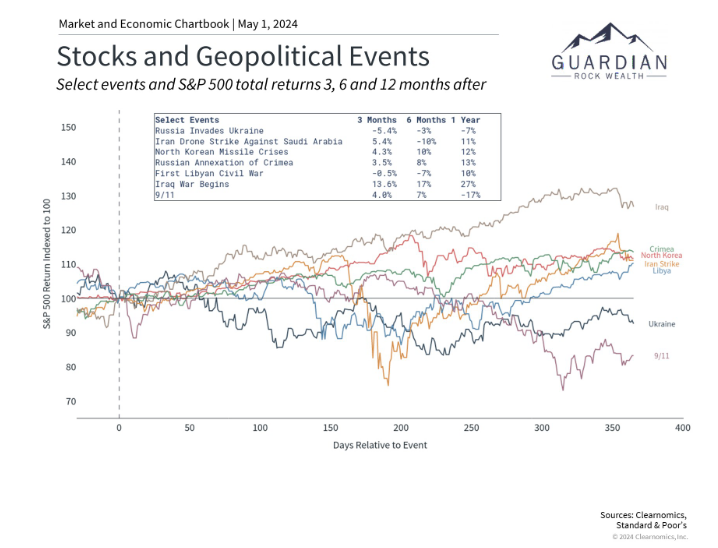

After a historically strong start to the year, markets have pulled back significantly as we head into May. Concerns continue around geopolitical tensions in the Middle East, inflation, corporate earnings, and other issues, pushing the VIX stock market volatility index to its highest level in six months. How do we maintain perspective and not overreact to headlines?

Iran, Russia, Ukraine, Israel, Gaza, The Read Sea Houthi rebels, China, Taiwan, inflation, interest rates, a strong dollar, weakening Asian Currencies, increased domestic oil production, 3-D printing, Artificial Intelligence, repatriation of manufacturing – All of these things and more factor into a complex adaptive market. The increasing complexity of the world economy makes diversification, asset allocation, investment innovation, and development of systematic, disciplined processes even more important than in the past.

The reality is that some of the headlines end up impacting the market very little over the long term.

Taking this ‘perspective’ conversation a bit further, as we continue to see corporate earnings and inflation numbers come in, it is good to remember that the comparisons for the headlines are generally made Year over year. So if one year ago, inflation or earnings numbers were particularly high, the comparison to this year may appear to be low. For example, Year over Year inflation may be up 3%, in a given month but if it is being compared to a month a year ago where inflation was up say 8% you can see how immediate headlines can distort perspective.

Keeping this in mind, I continue to believe Artificial Intelligence (A.I.) is the foundation of what is to come for our economy. The hardware companies have taken the bulk of the gains. While those profits will likely continue, we see those companies that utilize the data and AI most effectively in software, manufacturing, and other practical applications gaining traction.

Hold on to your hats. I think this year still has plenty of surprises left. Be systematic, disciplined, and consistent. Be careful just reading the headlines and look at things from different perspectives.

If you would like to learn more about how to create your personal paycheck protection program in retirement without relying on traditional fixed income so you are not worrying about running out of money or not being able to live your best life, reach out to us at the “Contact Us” section of Guardianrockwealth.com or by texting the word LIFE to 321-421-5213

This note is not investment guidance for you; it is information and opinion only.

Define your outcome and allow a skillful artisan to help you create it.

Please remember that this note is our opinion from a broad perspective based on over three decades of money management experience and is not personal investment advice.

For more information and a copy of the Amazon Best Selling Book Build A Life Not a Portfolio, text the word LIFE to 321-421-5213

Contact us to book John to speak at your next event.

“John makes investing, economics, and financial planning fun and enjoyable with his real-life stories while providing valuable tangible information listeners can use immediately to make positive changes in their lives.”

Additionally, you can tune into our weekly Building Your Life Podcastand search for topics of interest and our daily five-minute audio update.

Talk soon,

John

Phone: (561-) 327-4646

John Browning, MBA, and CSA®

Comments