September 2024 Market Update & Cold Plunges Can Be Good For You!

- Federico Donadio

- Sep 2, 2024

- 6 min read

Updated: Apr 10

September 2, 2024

John Browning, MBA and CSA® | CEO, Principal

Recently, one of my coaches suggested for the fourth time that I try the “cold plunge.” I have lived in the Chicago area for almost three decades before moving to South Florida, and I can tell you from experience that I am not a fan of being cold! Long story short, I finally tried it. Full disclosure – I tried it alone mainly so no one would hear me screaming like a twelve-year-old girl. Frankly, it was just as uncomfortable as I had imagined, but I practiced my breathing and mental focus skills and managed a full three minutes without screaming like a 12-year-old! Guess what? A few minutes later I began to feel great! All these years, I have ignored the experts who said this was a great idea because I, with no experience in this field, did not “think it was for me.”

As I think about this experience, I can relate to some of my clients who aren’t sure “financial planning or investing” is “right” for them. After years of doing things one way to try something new can feel like doing the “Cold Plunge,” this past month has caused some experienced investors to feel unnerved. A comment from a political figure, a piece of economic data, and one earnings call after another had the market creating a classic whiplash scenario.

However, financial markets have been resilient in recent weeks, almost entirely recovering from the swings experienced at the beginning of August. Major stock market indices are approaching all-time highs again, with the S&P 500 gaining 19.2% year-to-date with dividends, less than half of one percent below its peak. This upward trend has been fueled by Fed Chair Powell’s recent speech that laid the groundwork for a September rate cut. The past month is another reminder that market volatility is natural and unavoidable. Rather than fixating on day-to-day market headlines, investing based on longer-run trends may be a much better idea.

Corporate earnings drive market returns in the long run.

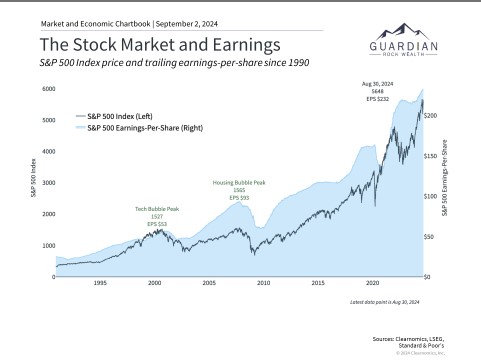

With market volatility subsiding, investors have shifted attention back to corporate earnings. Throughout market cycles, the stock market tends to mirror the trajectory of corporate profits, rising as the economy grows. This is because shares of a stock represent an ownership claim on a company’s profits. So, while markets can experience turbulence occasionally, a growing economy and rising corporate profitability have historically fueled the stock market.

This is demonstrated in the accompanying chart, which shows that markets and earnings do not move in perfect lockstep but typically follow similar patterns. There is generally a gap between markets and earnings; however, it represents market sentiment or how investors “feel” about the general economy, their paychecks, and which companies they feel will do well in the future. Fundamental analysis attempts to quantify this with ratios like the P/E or Price earnings ratio, which is essentially how much investors are willing to pay per dollar of earnings. Valuations have been expensive recently on a historically relative basis, so market pullbacks can be healthy as investors adjust expectations.

Over the past twelve months, S&P 500 earnings have risen to $232 per share, a healthy growth rate of 7.4%. This accelerated with second-quarter S&P 500 earnings growing at a blended growth rate of 10.9%, according to FactSet, which is just about where we were at the end of 2021. Investors may be jittery when they remember what happened during the long struggle of 2022 and early 2023 when recession concerns swept through the market.

While it’s positive that 79% of S&P 500 companies have reported higher-than-expected earnings, they have only beaten estimates by 3.5% on average. This is partly because S&P 500 revenue growth is below the 5-year average of 5.2%. The direction of sales is largely determined by the consumer, who makes up 2/3rds of economic activity in the coming quarters. Will the consumer and businesses react as hoped to the reduction in interest rates expected during September, or will they tighten their belts?

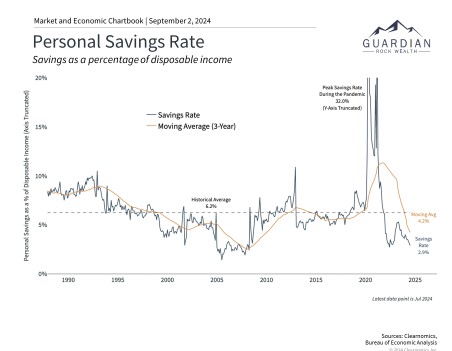

Consumer spending Concerns

Many companies are concerned about consumers’ financial health, especially given the economic swings and rapid inflation of the past few years. It’s no secret that the prices of everyday necessities such as food and housing have risen more than incomes have. While inflation is not rising as much as in recent years, prices remain high, and that lower inflation rate we keep hearing about is still an increase on already higher-priced items. This means the pressure on consumers remains high, particularly the lower and middle-income earners. As we can see in the chart above, the personal savings rate has quickly come down well below the historical average. Many companies cited worries about consumers during their most recent earnings calls.

On the one hand, the latest consumer spending data came in hotter than expected, showing a 1% month-to-month jump in retail sales compared to expectations of just 0.3%.

It’s also clear that consumer sentiment still suffers due to the higher prices of the past few years. The University of Michigan’s Consumer Sentiment Index is still well below average. In a recently published financial well-being index from Deloitte, sentiment appeared mixed. The highest earners reported higher consumer confidence or sentiment, with 74% of higher-income respondents saying their finances have improved in the last 12 months. However, the outlook is less rosy among middle- and lower-income earners, with just 61% and 50% of respondents reporting improvement.

Consumer net worth:

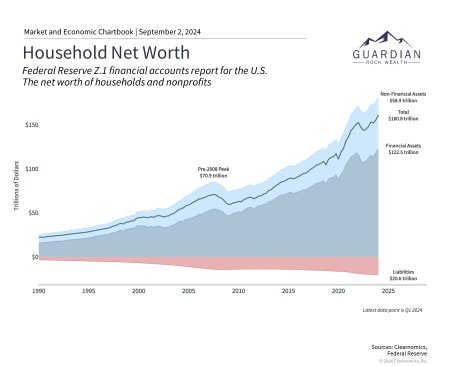

To end with some good news, however, there are early signs that consumers’ feelings about inflation are improving. A recent Survey of Consumer Expectations from the Federal Reserve Bank of New York revealed a significant drop in consumers’ expectations for inflation over the next three years, reaching a record low of 2.3% since the survey’s inception in 2013. The University of Michigan’s survey also showed that consumers anticipate only 2.9% inflation over the next year and 3% over five years, a significant improvement in recent months.

With inflation moving back toward 2%, the Fed poised to cut rates, and markets rebounding, household net worth has reached new all-time highs. The growing value of financial assets could also help support consumer spending and sentiment. This is often referred to as the “wealth effect” and, when business cycles are in their expansionary stage, historically drives further growth.

The bottom line:

When we combine these things with what continues to be, in our opinion, just the beginning of the artificial intelligence revolution, which could drive a new industrial revolution, we remain optimistic about the next 12 to 18 months in the market, even if at times, it may feel like a “cold plunge” in the short term. Focusing on your long-term goals, continuing to be prudent in your risk management, and keeping in mind that cash flow is king should continue to fuel your progress toward building your life using the tool we call money.

Copyright (c) 2024 Guardian Rock Wealth, All rights reserved. The information contained herein has been obtained from sources believed to be reliable but is not necessarily complete, and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.guardianrockwealth.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, exchange-traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Guardian Rock Wealth, and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Guardian Rock Wealth, shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Guardian Rock Wealth, expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof through electronic tracking technology and all other lawful means now known or hereafter devised. Guardian Rock Wealth reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

Comments