April 2025 Market Update: Market Volatility Survival Guide: How Preparation Beats Prediction in Uncertain Times

- Federico Donadio

- Apr 1

- 5 min read

Updated: Apr 10

April 1, 2025

John Browning, MBA and CSA® | CEO, Principal

The stock market is in correction territory due to tariff concerns; some investors may feel as if the market is stuck in a “Groundhog Day” loop. Fears of a trade war have kept markets choppy over the past month, particularly with the technology sector leading the downturn. Months of uncertainty have led some to think that financial markets will never stabilize. They are quick to forget the long road ahead in 2024.

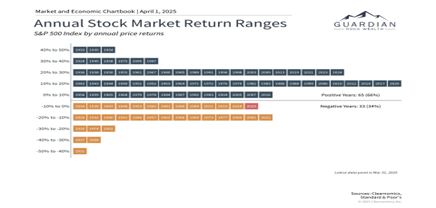

Booms and busts are natural parts of the market cycle. Although the winter months may be unpleasant and seem endless, warmer weather eventually returns. Similarly, market pullbacks have historically stabilized, paving the way for expansions and bull markets.

Market pullbacks are a natural part of the investment cycle:

It has been said that markets take the stairs up and the elevator down. Market recoveries tend to be slow-moving and compound over time, whereas the events that create short-term fear tend to be sudden. When zooming out, the stock market is back to where it was last September, which helps keep recent moves in perspective.

Stock market corrections occur regularly, averaging 14.3% since World War II. Despite this, Major indices have historically recovered within months with rebounds often occurring when least expected, as seen during the pandemic in 2020, after the tech-led bear market in 2022, and following the banking crisis in 2023.

Preparation Trumps Prediction:

In my experience, attempts at market timing are often a futile endeavor. Long-term investment success tends to come not from predicting everything that will happen perfectly, but from preparing well for whatever happens. Preparing your portfolio for changing market conditions is like hurricane-proofing a house in Florida. While you hope a hurricane never tracks in your direction, it’s naive— and dangerous —to convince yourself it’ll never happen. The same applies to market corrections – they’re inevitable, but their timing and severity remain unpredictable.

What does proper preparation look like?

Building diversified portfolios that can withstand various economic scenarios

Stress-testing your investments against different market conditions

Setting appropriate expectations about market volatility

Creating an investment plan that acknowledges the inherent unpredictability of markets

Morgan Housel once said:

“The biggest advantage in investing is not IQ or access to information; it’s behavior and temperament.”

Preparation helps establish the right mindset and systems to maintain disciplined behavior when markets become turbulent.

Another great quote comes from Peter Lynch:

“far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.”

The critical factor is building resilient portfolios that can withstand market volatility while staying aligned with your financial goals.

Tariffs n’ Tech

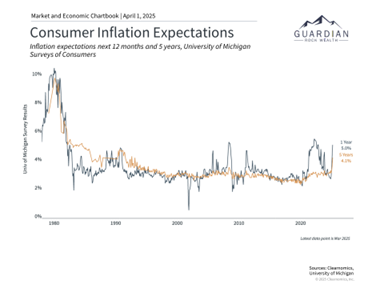

Investors have grappled with the wide range of potential outcomes from the administration’s use and threat of tariffs, which are often employed as a negotiating tactic. In the short run, fear of higher prices has already impacted consumer sentiment who worry about inflation returning. Technology stocks that drove markets higher in recent years have led to market declines. It’s important to view these moves in context, as the Magnificent seven stocks had risen significantly over the entire cycle.

Meanwhile, many other sectors have performed better, including Energy, Healthcare, Utilities, and Financials. Over the past year, eight of the eleven S&P 500 sectors have remained in positive territory, despite recent swings, underscoring the importance of diversification, which Interestingly, has hurt investors in the S&P 500 and the NASDAQ Index, which are overweight in those Mag7 companies.

Economic Indicators: Are the concerns justified?

Headline inflation rose 2.8% year-over-year in March, while Core inflation increased 3.1%. Consumer sentiment fell to 57, its lowest level since 2022, with consumers expecting 5% inflation over the next year.

The Federal Reserve kept rates unchanged within a range of 4.25% to 4.5% in March but slowed the pace of balance sheet reduction. Given limited visibility into trade policy outcomes, the Fed downgraded its economic outlook to just 1.7% GDP growth for 2025.

Despite concerns about inflation and declining consumer sentiment, consumer spending remains healthy, supported by a still robust job market with unemployment still low and wages continuing to rise. However we caution that this may change quickly in the coming months as DOGE cuts filter through the economy

The Power of Asset Class Diversification:

Bonds have recently resumed their traditional role of offsetting stock market pullbacks. When growth concerns push interest rates down, bond prices tend to rise, supporting balanced portfolios. Many types of bonds have performed well this year, including TIPS, mortgage-backed securities, Treasury’s, and corporate bonds. However, the outperformance has caused yields (also known as cash flow) to drop hurting those who strictly rely on bonds for their income.

This marks a notable shift from recent history. In 2022, during one of the steepest equity drawdowns in recent memory, bonds failed in their role as a hedge against equity. The S&P 500 Index lost 24% from its peak in December 2021 to its trough in September 2022, while a balanced ’60/40′ portfolio lost 19% – less damage, but not by much. The spike in inflation in 2022 was a powerful driver of this positive correlation between stocks and bonds. When inflation increases to levels that concern investors, stocks and bonds can perform poorly simultaneously, as was the case in 1969 when the Consumer Price Index rose above 6%. The S&P 500 lost 8.5%, and long-term Treasury bonds declined 5.1%.

International markets have also performed well recently, with developed markets gaining 6.1% and emerging markets up 2.4% in the first quarter. This highlights the importance of geographic diversification. However, international investment carries significant risks that should not be overlooked. Notably, over the past decade, the S&P 500 has outperformed global equities for nearly 13 years. During the 2022 bear market, companies with high foreign revenue exposure experienced more pronounced declines than the broader S&P 500. In 2023, the S&P 500 outperformed the MSCI All Country World Index by more than 10%. International investment also introduces risks of geopolitical and economic instability, including hyperinflation in Argentina and other countries, as well as political unrest and government intervention in other countries.

A portfolio that includes domestic stocks, bonds, and a carefully considered allocation to international investments may create a smoother ride through market volatility. However, it may not result in a portfolio that outperforms.

As always nothing in this communication should be construed as personal Guidance & past performance is no guarantee of future results. There is a risk of loss associated with investing. No representation or implication is made that any methodology or system will generate profits or ensure freedom from losses. Guardian Rock LLC and its affiliates are fiduciary investment advisors. Please consult with us before making investment decisions and/or attempting to implement the strategies and tactics we discuss in any of our publications. Copyright April 2025 Guardian Rock Wealth Investment Mgmt Inc.

Commentaires